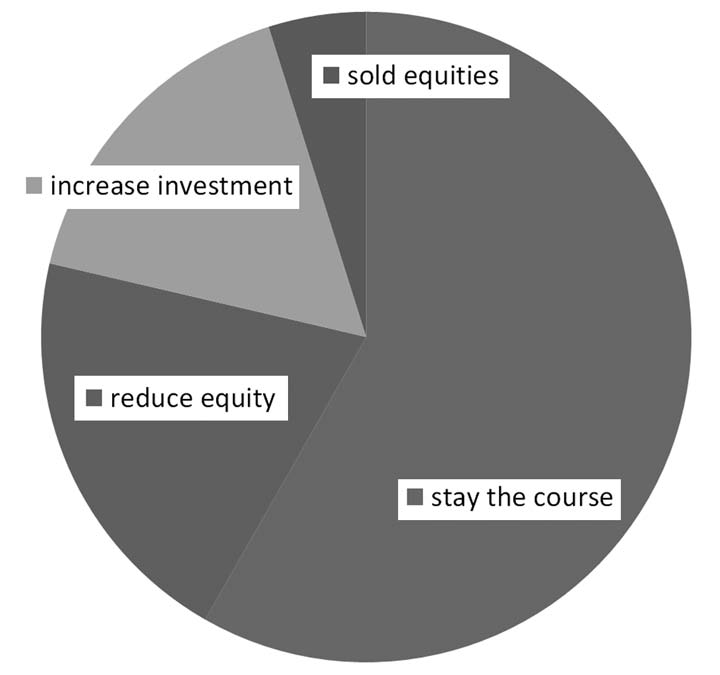

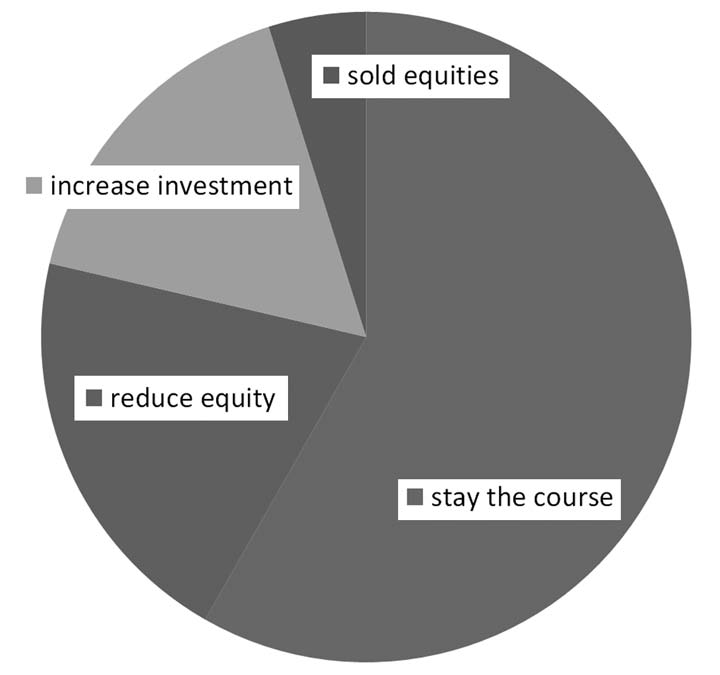

In a short period of time, from May-June 2009, experts at Vanguard surveyed U.S. investors, finding that three-quarters of all American households with $5,000 or more to invest, invest a portion in equities. Overall wealth and educational level attainment are related to a household’s participation in investing, as is the age of the investor. Investors who are at or near retirement age have less exposure and are therefore less likely to hold equities than are younger investors. The survey also found that even during the correction in 2008 to 2009, 60% of investors stayed the course without making major changes to their investments; 21% of investors reduced their exposure to equities; 5% sold all their equity holdings; and 17% saw the correction as an opportunity to increase their investments in equities. Some reasons for this dynamic may include how near investors were to reaching retirement age during this period of turmoil, their individual mortgage financial position at the time, and whether their jobs were secure.