Individual StocksIndividual Stocks: The Basics |

What are some important points to know when I invest in stocks? |

According to experts at CNN/Money, you need to understand several important points when you begin to invest in stocks. A stock represents your ownership in a company, and also represents your ownership of assets, liabilities, and current and future earnings or profits of the company (and the perception of the possibilities of hitting these earnings targets). The stock market is a very diverse marketplace consisting of many entities that can be arranged and understood by several attributes, including the size of the company (measured by market capitalization), the sector in which it competes, and its type of growth pattern based upon historical performance, among many others.

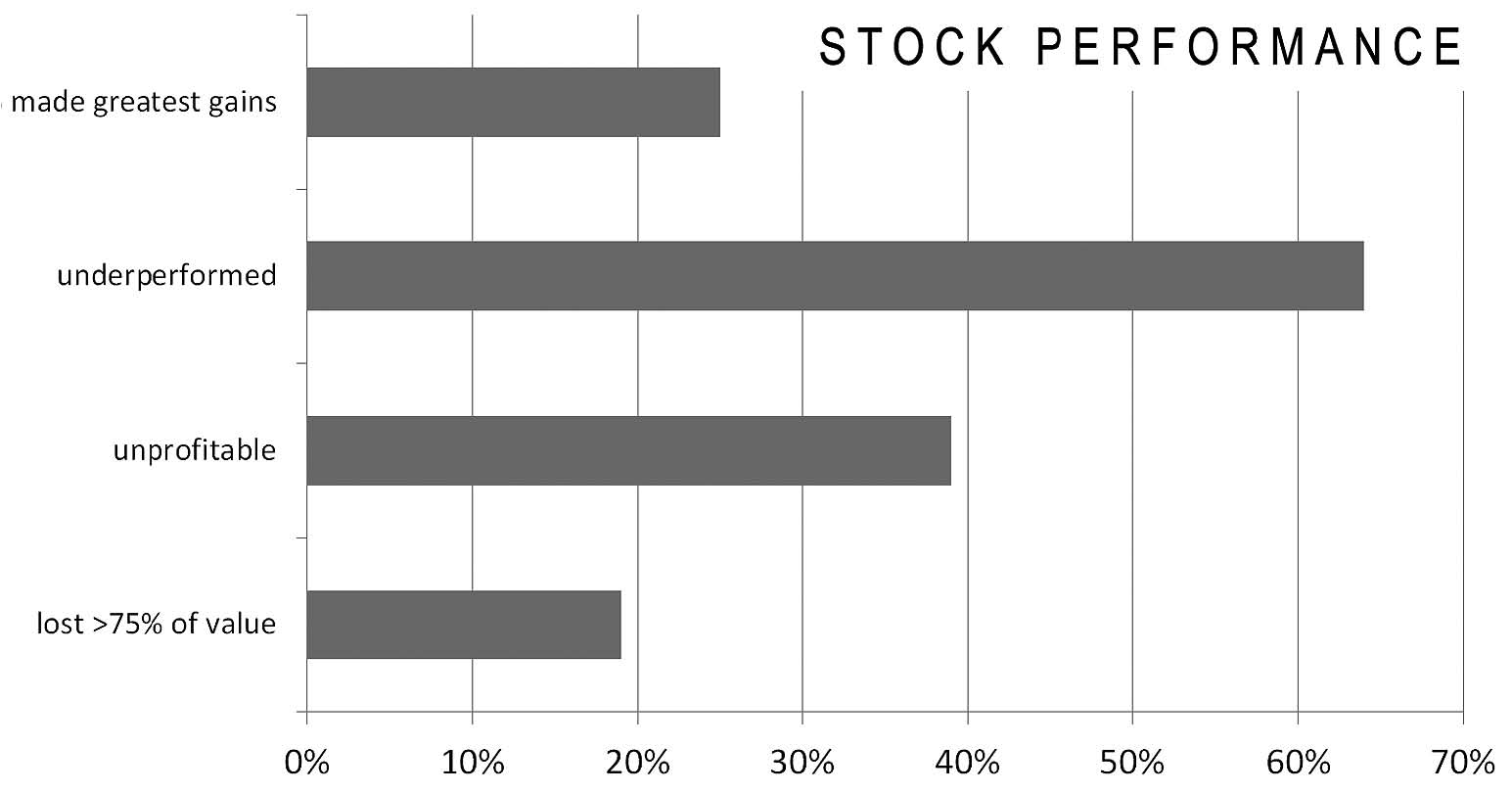

The price of a stock at any given moment depends on a wide variety of factors, including earnings, especially for the long-term investor. It may also be influenced by the sentiment of its buyers and sellers, fear created by information about the company and its competitors, and macroeconomic news that may have an effect on the company’s performance. According to the same experts, since the 1940s, stocks (as compared against bonds, cash, real estate, and other savings choices) provide for nearly a 10% return over the long term, better than most other investment choices. It is important to note that the performance of any one individual stock does not represent the overall performance of the market. A great individual stock may beat an index over time, but may also decline even when the market in general is booming.

Because of the dynamic nature of businesses and the marketplace, it is difficult to use a stock’s historical performance to gauge whether or not its value will continue to grow; even great companies run into unexpected problems. These unexpected occurrences may influence a stock’s price and value. Diversification of a portfolio seems to mitigate many risks. Furthermore, you should not judge a stock simply by looking at its price or the relative price in its sector or industry, because there are many fundamental factors that may contribute to a stock’s underlying price. For the long-term investor, it is better to buy and hold great stocks than to generate many short-term trades for a variety of expense-related reasons, such as short-term capital gains taxes, commissions on trades, and exposure to many market risks.