Surviving Financial CrisesIdentity Theft |

What do they know about me? |

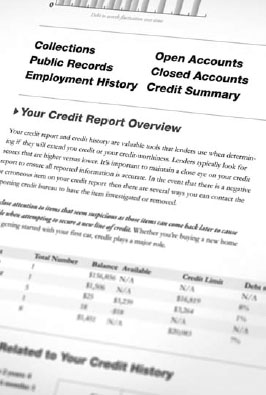

Credit reporting companies know all of your debts, credit card balances, available lines of credit, mortgage amounts and balances, checking and savings balances, bankruptcies, wage information, job history, all addresses both current and previous, car loans, liens on property, history of credit applications, both denials and acceptances, child support payments and of course your credit score.

Check your credit report once a year to make sure that there is no unusual activity attributed to you, including opened accounts that you know you did not open yourself. You can obtain a free credit report annually by contacting the companies Equifax, TransUnion, or Experian.